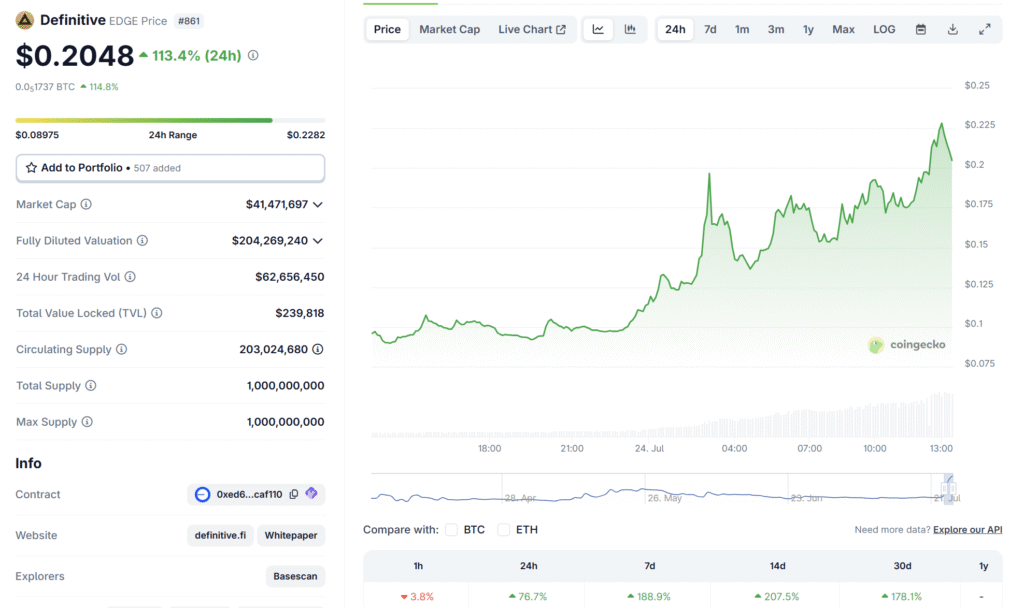

The price of Definitive’s EDGE token has increased by more than 100% within a single day, drawing significant attention from the trading community in decentralised finance.

The token rose from approximately $0.089 to over $0.20, supported by over $60 million in daily trading volume.

Rather than being driven solely by speculation, this increase appears to reflect growing interest in reliable onchain trading infrastructure.

In this deep dive, we will examine what Definitive offers, how it functions, and how users may benefit from its services and token utility.

What is Definitive?

Definitive is a decentralised trading platform designed to provide execution quality comparable to that of centralised exchanges.

It was developed by the team that built the trading engine for Coinbase Prime, and it aims to give users of all types, from individuals to institutions, access to consistent and efficient trading experiences directly onchain.

The platform supports major EVM-compatible networks such as Ethereum, Arbitrum, Polygon, Avalanche, Base, and also operates on Solana. Its primary objective is to simplify onchain trading by solving common issues such as fragmented liquidity, limited automation, and difficult interfaces.

What makes Definitive notable is how it combines multiple services into a single platform. To better understand its offering, it is helpful to look at the range of features that support its user experience.

What Are Its Features?

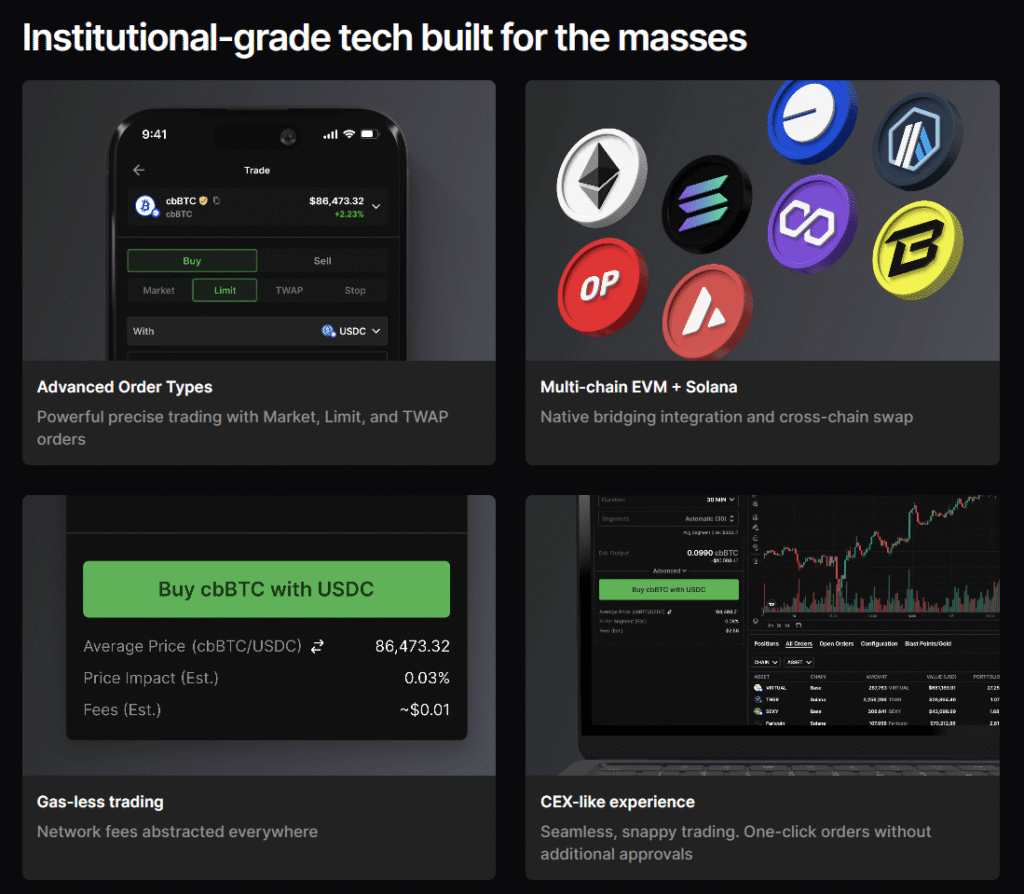

Definitive provides a complete suite of trading tools intended to improve the accuracy, speed, and flexibility of onchain trading. The following are its key features:

1. Order Types

Definitive supports various order types including market, limit, TWAP (time-weighted average price), and stop orders.

Market orders execute immediately at the best available price, while limit orders allow users to set specific target prices. TWAP orders help reduce price impact by dividing large trades over time. Stop orders are used for managing risk by triggering buys or sells at a specific price.

These orders can be configured using values denominated in USD, regardless of the token pair.

2. Adaptive Slippage and Routing

The platform uses a smart slippage mechanism that adjusts to market conditions in real time. This improves the success rate of trades and reduces exposure to manipulation or failed transactions.

Routing decisions are based on data from more than one hundred decentralised trading venues and over fifteen private market makers.

3. Gas Abstraction

Definitive handles network fees directly within its system. This removes the need for users to manage gas balances across different networks. Instead, gas costs are covered in advance and deducted from trade results.

4. Private Order Submission

Orders are sent to a private order management system and only executed onchain when conditions are met. This protects trading intent from being exposed to third parties and avoids unnecessary broadcasting of orders.

5. Institutional Trading Tools

The platform provides analytics and reporting tools suitable for professional use. These include real-time position tracking, role-based access control, sub-account functionality, and automated post-trade reporting.

6. Bridging Integration

Through a system called Bungee, Definitive supports asset transfers across chains. Users are presented with optimal routes and fees when bridging assets, allowing them to move capital efficiently between networks.

7. High Congestion Support

For busy markets or token launches, users can activate a mode that increases priority fees and slippage tolerance. This setting is optional and intended to improve execution success during periods of high demand.

These features are all powered and enhanced through the platform’s utility token. Understanding how the EDGE token works helps explain how the platform provides ongoing value to its users.

What Is the EDGE Token?

EDGE is the token used to access and enhance functionality within the Definitive platform. It is an ERC-20 token deployed on Base and has a fixed total supply of one billion tokens. Below is an overview of its allocation and intended purpose.

Token Details

- Total supply is set at one billion EDGE

- Approximately 203 million EDGE are currently in circulation

- The maximum supply is capped at one billion

Allocation

- Community receives 49%, with about 11% distributed through an initial airdrop and the remainder reserved for future incentives

- Treasury holds 9.46%, already unlocked

- Team is allocated 26.9%, subject to a one-year lock followed by a two-year release schedule

- Investors hold 14.64%, with the same locking and vesting terms as the team

This means the current circulating supply only includes tokens from the community airdrop and the treasury. The rest of the supply remains locked.

Utility

The primary use of EDGE is to reduce trading fees on the platform. Users who stake EDGE gain access to reduced fees, and over time, the platform intends to extend additional features and benefits to token holders. These may include early access to new tools or a share of future rewards.

Having reviewed how the token works, we can now look at how users can apply it in practice to gain more value from using Definitive.

How Do I Profit From Definitive?

Users can benefit from Definitive in two main ways: by using its trading features and by staking the EDGE token.

Trading

Definitive provides tools that make trading more precise and less time-consuming. Users can choose between market orders for fast execution or limit and TWAP orders for greater control. Stop orders can help manage downside risk without requiring constant monitoring.

These options allow both smaller users and larger funds to execute strategies across a wide range of assets. The platform supports tokens that are not available on centralised exchanges, giving users broader access to liquidity.

Staking EDGE

Staking EDGE gives users access to reduced trading fees. The exact fee depends on the user’s trading volume over the past 30 to 180 days and the amount of EDGE staked. The system rewards higher-volume traders with better rates.

Here is how the fee tiers are structured for users who stake EDGE:

- Tier 1

- Trading volume: 20 million USD or more (in the past 30 days or more, based on stake)

- Market order fee: 0.05%

- Advanced order fee (TWAP, limit, stop): 0.05%

- Tier 2

- Trading volume: 5 million USD or more

- Market order fee: 0.05%

- Advanced order fee: 0.10%

- Tier 3

- Trading volume: 1 million USD or more

- Market order fee: 0.10%

- Advanced order fee: 0.15%

- Tier 4

- Trading volume: 100 thousand USD or more

- Market order fee: 0.10%

- Advanced order fee: 0.20%

- Tier 5

- Trading volume: Below 100 thousand USD

- Market order fee: 0.15%

- Advanced order fee: 0.25%

To qualify for any of these reduced rates, a minimum of 2,000 EDGE must be staked. The more EDGE a user stakes, the longer the lookback window for volume calculation:

- 2,000 EDGE = 30-day volume window

- 20,000 EDGE = 60-day volume window

- 200,000 EDGE = 90-day volume window

- 2,000,000 EDGE = 120-day volume window

- 10,000,000 EDGE = 180-day volume window

This model allows frequent traders to unlock lower fees more efficiently and maintain them for longer periods, depending on their EDGE staking level.

Conclusion

Definitive is a trading platform built to simplify and improve the onchain trading experience. It brings together multiple tools, including advanced order types, gas management, private execution, and cross-chain trading in one place.

The increase in the price and trading volume of the EDGE token suggests that more users are recognising the platform’s utility. By staking EDGE or using Definitive’s trading services, users can access lower fees, improved order execution, and a structured approach to managing trades directly onchain.

Definitive continues to focus on practical improvements to DeFi trading. With ongoing product development and support for multiple chains, it offers users a reliable environment for executing and managing onchain trades.