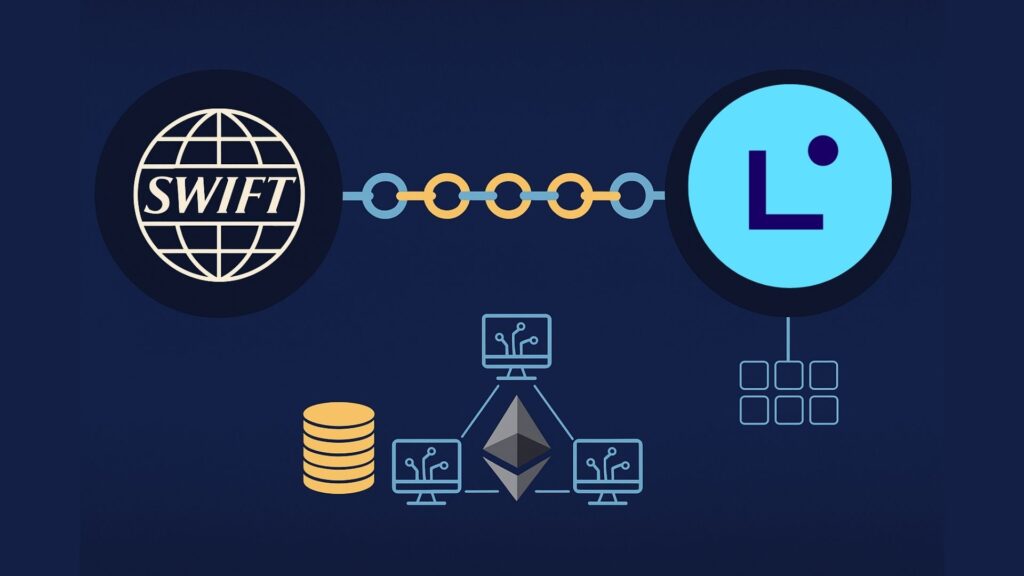

SWIFT, the world’s largest financial messaging network, has officially confirmed that its new blockchain payment system is being built on Linea, Ethereum’s Layer-2 network developed by Consensys.

The news was revealed by Consensys CEO Joe Lubin at Token2049 in Singapore, confirming months of speculation about the project’s underlying blockchain.

Linea, which leverages zk-rollup technology to scale Ethereum, will provide the infrastructure for real-time, 24/7 crypto settlements between global banks.

The move marks a historic step for both traditional finance and decentralised finance, signalling a major shift in how international payments are processed and secured.

Linea’s Technology and Ecosystem

Linea is a Layer-2 scaling solution designed to enhance Ethereum’s transaction speed and efficiency without compromising its security.

Developed by Consensys, the same company behind MetaMask and Infura, Linea operates through zk-rollup technology, specifically a zero-knowledge Ethereum Virtual Machine (zkEVM).

This allows it to process large numbers of transactions off-chain and later verify them on Ethereum using cryptographic proofs. As a result, transaction fees are significantly reduced, and throughput is much higher compared to the Ethereum mainnet.

What makes Linea particularly attractive to developers is its EVM equivalence. This means existing Ethereum-based smart contracts and decentralised applications can be deployed directly onto Linea without requiring code changes.

For projects and builders already embedded in Ethereum’s ecosystem, this seamless compatibility saves time and cost, promoting faster adoption.

Linea’s recent Token Generation Event (TGE) distributed around 9.36 billion LINEA tokens, available for claim within 90 days.

The tokenomics introduced a dual burn mechanism: a portion of transaction fees paid in ETH is burned, while another portion is used to buy back and burn LINEA tokens, steadily reducing supply.

Despite facing a temporary outage caused by sequencer issues, Linea’s development team quickly resolved the problem and restored block production. This demonstrates both the network’s active maintenance and its growing reliability as one of Ethereum’s most prominent scaling solutions.

With a total value locked (TVL) of roughly $2.27 billion, Linea currently stands as the fourth-largest Ethereum Layer-2, trailing only Arbitrum One, Base, and OP Mainnet according to data from L2BEAT.

SWIFT’s Strategic Move Toward Blockchain

SWIFT’s decision to build its next-generation payment system on Linea signifies one of the most significant institutional shifts toward blockchain adoption in modern finance.

For decades, SWIFT has been the backbone of global payments, facilitating around $150 trillion in transactions every year across thousands of financial institutions.

By choosing Linea, SWIFT is not just experimenting with blockchain, it is integrating decentralised technology directly into its core infrastructure.

Earlier this week, SWIFT announced a collaboration with Consensys and over 30 major banks and financial institutions to create a 24/7 real-time crypto payments system.

While the organisation initially refrained from naming the blockchain involved, many in the industry suspected it would be Linea. Joe Lubin’s confirmation has now validated those assumptions.

According to Lubin, when SWIFT’s CEO Javier Pérez-Tasso made the original statement, the decision to withhold Linea’s name was deliberate. The announcement was first introduced quietly to key players within the banking sector, a “soft launch” intended to gauge reactions.

The response, Lubin said, was overwhelmingly positive, with many viewing it as a long-awaited connection between decentralised finance (DeFi) and traditional finance (TradFi).

Linea’s technology makes it well-suited for such a system. Its zkEVM rollups enable fast, low-cost transactions while maintaining full compatibility with Ethereum, providing both transparency and security. The scalability ensures that even with high global payment volume, performance remains stable.

Some of the biggest banks, such as Bank of America, Citi, JPMorgan, and Toronto-Dominion Bank, are already participating in early tests of the new system.

If successful, this blockchain-based rail could challenge existing cross-border payment systems, including Ripple’s XRP Ledger, which has long positioned itself as the blockchain solution for banking transactions.

SWIFT’s integration of blockchain through Linea highlights a clear direction for the future of finance: global settlements that are faster, cheaper, and available at all times without dependence on traditional intermediaries.

It bridges a long-standing gap between the efficiency of decentralised systems and the trust-based structure of established financial networks.

Conclusion

SWIFT’s adoption of Linea marks a defining moment for the convergence of blockchain and global finance.

By utilising Ethereum’s Layer-2 scaling technology, the network gains both the security of Ethereum and the performance benefits needed for high-volume international payments.

Linea’s zk-rollup structure ensures efficiency, while its compatibility allows seamless integration for institutions already operating within Ethereum’s ecosystem.

As the testing phase continues, SWIFT’s move could set a new standard for financial infrastructure worldwide. If the system performs as intended, it will not only modernise cross-border payments but also prove that decentralised networks can serve as reliable backbones for global finance.

Contributor: Lydicius