The metaverse may not be fading after all. In August, non-fungible token sales linked to virtual worlds rose by 27% compared with July, with 13,927 transactions recorded.

Although total trading value slipped slightly to $6.5 million, the increase in the number of sales suggests that users are starting to return to metaverse platforms. This is the second consecutive month of heightened activity, which analysts at DappRadar believe signals renewed interest.

For everyday users, the message is simple: the metaverse is showing signs of life after a long slowdown and could be quietly regaining its relevance in digital culture.

The Roadmap of Metaverse Activity

The figures come from DappRadar, which tracks decentralised applications and digital assets. In July, the metaverse registered $6.7 million from 10,900 sales, which itself was a sharp increase from June’s $3.7 million and 12,800 sales.

August’s continuation of this growth pattern, even with a slight dip in dollar value, confirms that activity is not an isolated spike but part of a steady return.

Sara Gherghelas, an analyst at DappRadar, commented that the metaverse is not dead and users seem to be sneaking back into worlds such as Sandbox, Mocaverse, Otherside, and Decentraland.

Each of these platforms has rolled out new developments that may be attracting returning participants.

Sandbox held its largest Land auction in July, giving creators more opportunities to expand their virtual plots. Mocaverse is preparing to launch Moca Chain, with a testnet scheduled in the near term, connecting parts of its Web3 ecosystem.

Otherside by Yuga Labs unveiled artificial intelligence-based world-building tools in August, making it easier for users to create interactive spaces.

Meanwhile, Decentraland has upgraded its graphics engine to provide smoother experiences. HYTOPIA also replaced its old token with HYBUX and boosted its creator fund.

Together, these moves highlight that top platforms are focusing on infrastructure and user tools rather than hype alone.

The broader data shows mixed performance this year. January recorded the highest sales with $7.7 million, while April and May had the largest trading volumes at more than 19,000 each.

Still, August’s figures represent the first time in 2025 that growth has been sustained across two months, which is why they carry symbolic weight.

The metaverse, which reached peak popularity in 2021 and 2022 before slowing sharply in 2023, now appears to be moving towards a steadier and more realistic phase of development.

The Condition of Metaverse Coins

Alongside the growth in NFT sales, metaverse-related coins have shown resilience and, in some cases, strong short-term gains.

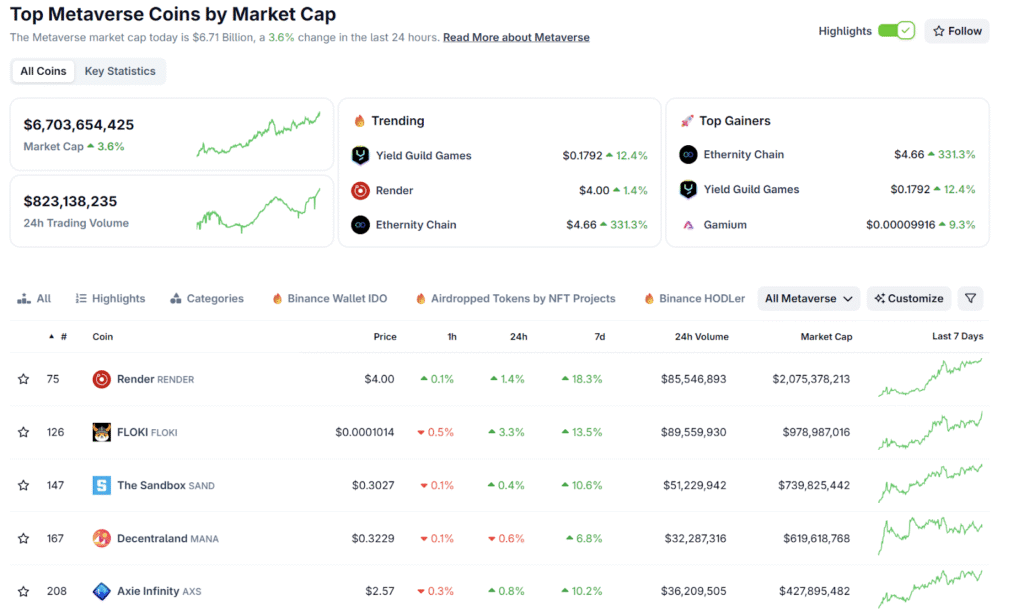

According to market data from Coingecko, the total capitalisation of metaverse coins stands at $6.7 billion, with daily trading volumes of more than $823 million.

This represents a 3.6% increase within the last 24 hours, suggesting that interest in tokens linked to virtual platforms is aligning with the increase in activity within the worlds themselves.

Among the top five metaverse coins by market size are Render, FLOKI, The Sandbox, Decentraland, and Axie Infinity. Render leads this group with a price of $4.00 and a market cap exceeding $2 billion, supported by $85 million in daily trading.

FLOKI, while priced at a fraction of a cent, has nearly $1 billion in market value and $89 million in trading volume, reflecting the popularity of meme-linked tokens with metaverse potential.

The Sandbox trades at around $0.30 with a market cap of $739 million, continuing to benefit from its active land auctions and creator engagement. Decentraland sits at $0.32 with a market value of $619 million, following its technical engine improvements.

Axie Infinity, known for its play-to-earn gaming origins, trades at $2.57 with $427 million in value and $36 million in volume, maintaining its place among the main metaverse names despite slower growth compared to its peak.

Trending coins also reflect renewed enthusiasm. Ethernity Chain, trading at $4.66, has surged by more than 331% and is the clear outlier in terms of short-term performance.

Yield Guild Games rose by 12% to $0.17, reflecting increased attention to guild structures that support play-to-earn economies.

Render also appeared among trending assets with its recent 1.4% rise, demonstrating steady investor confidence. Gamium, though very small in price at just under $0.00001, gained over 9%, showing that even microcap projects in the metaverse space are attracting trading activity.

What stands out in these figures is not only the growth but also the diversity. From high-cap infrastructure tokens like Render to experimental tokens like Gamium, the entire range of metaverse assets has shown movement.

This suggests that investors are not only speculating on one or two major projects but are exploring opportunities across the sector.

The 18% weekly growth in Render and double-digit gains for FLOKI and Axie Infinity reflect broader interest, likely supported by news of NFT sales climbing again.

These market dynamics connect directly with the developments taking place on the platforms themselves. As Sandbox, Mocaverse, Otherside, and Decentraland push forward with new features, their native tokens remain active in the market.

The combination of increased trading, ongoing development, and a gradual return of users indicates that the metaverse is entering a period of cautious recovery.

While far from the speculative highs of its earlier years, the space is showing a balance between infrastructure building and market activity.

Conclusion

The recent increase in NFT sales and trading volumes shows that the metaverse is still evolving. August marked the second consecutive month of growth, with platforms such as Sandbox, Mocaverse, Otherside, and Decentraland pushing forward with upgrades and new tools.

At the same time, metaverse coins have gained in both value and trading activity, with Render, FLOKI, The Sandbox, Decentraland, and Axie Infinity maintaining strong positions.

Trending names such as Ethernity Chain and Yield Guild Games underline the diversity of activity in the sector. While growth is moderate, the metaverse is not dead. It is showing signs of gradual recovery.