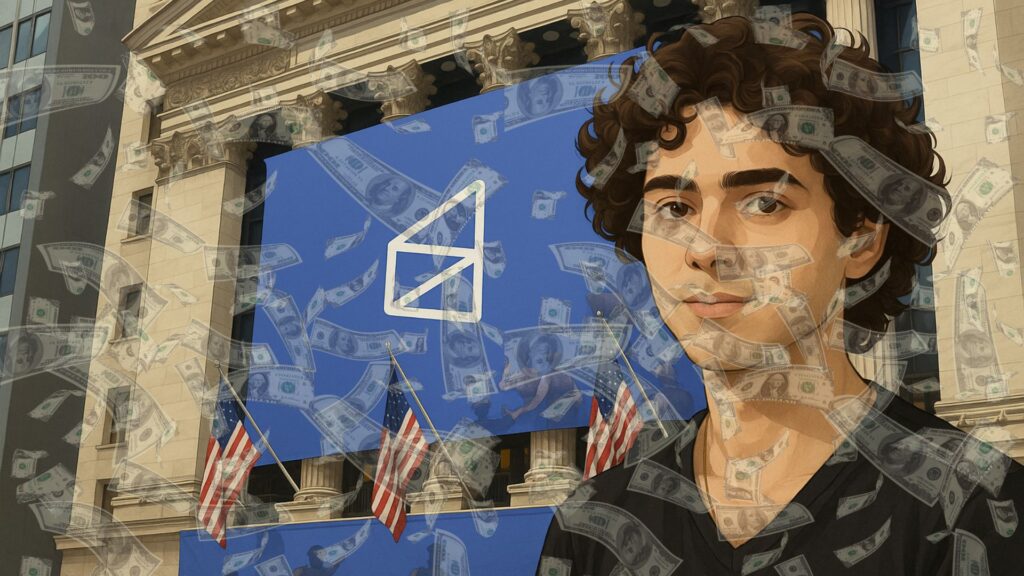

At just 27, Shayne Coplan, the founder and CEO of Polymarket, has become the youngest self-made billionaire in the world.

He reached this milestone following a landmark $2 billion investment from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange.

The deal places Polymarket’s valuation at $9 billion and marks a defining moment for both Coplan and the prediction market industry he helped pioneer.

Youngest Self-Made Billionaire

Shayne Coplan launched Polymarket in 2020 after a year spent researching how blockchain-based prediction markets could improve global decision-making.

His idea was simple yet ambitious: to create a transparent and decentralised platform where users could speculate on real-world outcomes, from political elections to sports and macroeconomic events, using cryptocurrency.

The turning point came during the 2024 U.S. presidential election, when trading volumes on Polymarket exceeded $3 billion.

What began as a crypto experiment suddenly became a mainstream sensation, attracting global media attention and institutional curiosity. Yet, alongside its rapid rise came regulatory scrutiny.

In 2022, the U.S. Commodity Futures Trading Commission fined Polymarket $1.4 million for operating an unregistered trading platform.

Soon after, the platform blocked U.S. users, but regulators remained cautious. Matters escalated in 2024 when the FBI raided Coplan’s apartment following allegations of continued access by U.S. traders.

By mid-2025, the situation had dramatically shifted. Both the Department of Justice and the CFTC dropped their investigations, effectively clearing the company’s name.

Polymarket then acquired QCEX, a CFTC-licensed exchange and clearinghouse, securing its right to operate legally within the United States.

This strategic acquisition transformed Polymarket from a regulatory outsider into a compliance pioneer, a key factor that likely paved the way for ICE’s confidence in its operations.

Before ICE’s involvement, Coplan had already steered Polymarket through several funding rounds that were previously undisclosed. In 2024, Blockchain Capital led a $55 million investment at a $350 million valuation.

A year later, Founders Fund led another $150 million round at a $1.2 billion valuation, joined by prominent backers such as Ribbit Capital, Valor, Point72 Ventures, Coinbase, Dragonfly, and 1789 Capital. In total, Polymarket raised nearly $279 million before ICE’s monumental deal.

The ICE investment of up to $2 billion pushed the company’s valuation to $9 billion, positioning Polymarket among the top-tier players in decentralised finance.

Beyond financial growth, the partnership represents something larger: the integration of traditional finance with decentralised systems.

ICE’s decision to back Polymarket signals that prediction markets, once viewed as a niche crypto experiment, are now being recognised as a legitimate part of the global financial infrastructure.

For Coplan, the deal also symbolises personal vindication. From facing regulatory setbacks to becoming the youngest billionaire, his journey mirrors Polymarket’s transformation from controversy to credibility.

Today, Polymarket is not only legal in the U.S. but also regarded as a major player redefining how financial markets and real-world events intersect.

Potential Token Launch

Just as Polymarket celebrates its new valuation, speculation has begun about a possible native token. Shayne Coplan recently teased the idea of a “POLY” token on X, comparing it to Bitcoin, Ethereum, Binance Coin, and Solana.

The post immediately sparked widespread discussion, with many interpreting it as a hint that Polymarket could soon launch its own cryptocurrency.

This is not the first time the idea has surfaced. In late 2024, Polymarket’s official account briefly hinted at “future drops,” suggesting potential user rewards or token-based incentives.

However, this new teaser carries greater weight, especially given the timing. ICE’s recent investment has solidified Polymarket’s legitimacy, and the introduction of a token could be the next step in expanding its ecosystem.

If launched, the POLY token could play several roles. It might serve as a governance tool, allowing users to vote on market-related proposals, or act as an incentive mechanism to reward participants for trading activity and liquidity contributions.

Such a structure would mirror successful decentralised trading protocols like dYdX, which integrated governance and reward features through its token model.

Hints of a potential launch can also be found in regulatory filings. In September 2025, Polymarket’s parent company, Blockratize, mentioned “other warrants” in an SEC filing. This could imply preparations for future token allocation, possibly to early investors or key partners.

While no official announcement has been made, the combination of corporate transparency and public hints suggests that POLY may indeed be in the works.

The implications of a POLY token would be far-reaching. It could turn Polymarket from a centralised platform into a more community-driven ecosystem, aligning user incentives with the platform’s long-term success.

With billions in trading volume and growing institutional partnerships, the token could also attract a new wave of investors looking for exposure to event-based financial markets.

Polymarket’s rise coincides with broader developments in the sector. Rival platforms like Kalshi have partnered with Robinhood to provide regulated access to event-based trading.

Yet Polymarket’s early mover advantage, regulatory clarity, and institutional backing from ICE make it a formidable leader. Should POLY be introduced, it could further strengthen this position and enhance Polymarket’s presence across the decentralised finance landscape.

Coplan’s achievements extend beyond financial success. His leadership has turned a once experimental idea into an institutional-grade platform bridging the gap between blockchain technology and traditional finance.

Now, with a possible token launch on the horizon, he is poised to redefine how predictive data and decentralised governance coexist in modern markets.

Conclusion

Shayne Coplan’s story embodies a rare combination of innovation, resilience, and timing. From facing regulatory penalties to leading one of crypto’s most valuable platforms, his journey reflects how far decentralised prediction markets have come.

The $2 billion investment from ICE not only marks a personal triumph but also represents the growing convergence between decentralised systems and Wall Street.

As whispers about the POLY token continue to grow, Polymarket’s next chapter could see it evolve from a prediction platform into a cornerstone of predictive finance, one that continues to blur the line between speculation and strategy in the global economy.