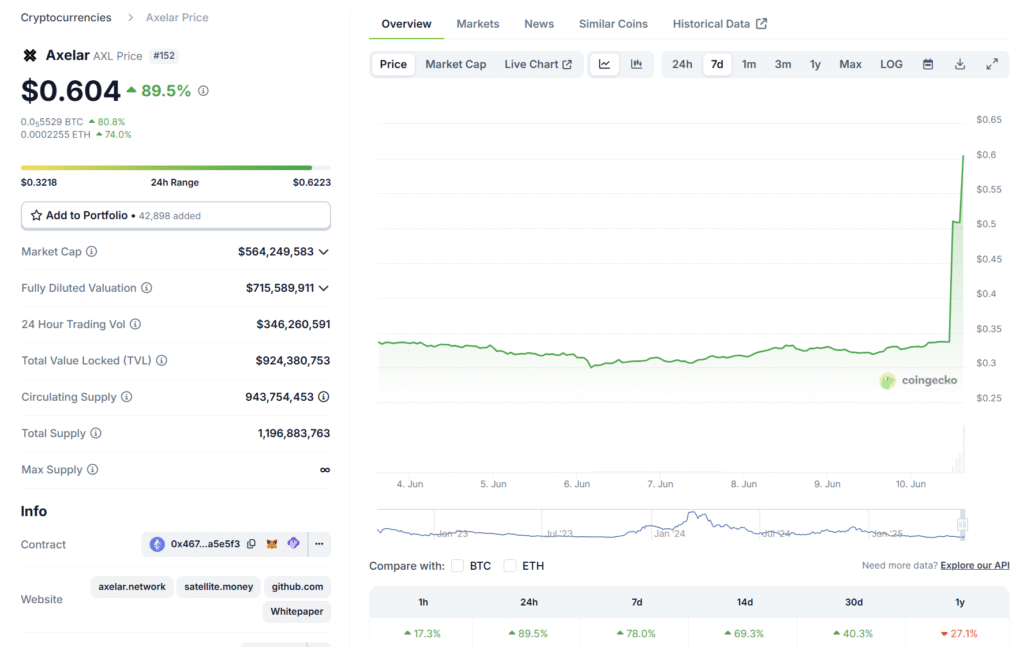

The token for Axelar, $AXL, has surprised many by soaring nearly 100% within a single day. While such a sharp rise grabs attention, few truly understand what the project does.

Before rushing to buy in, it’s worth exploring what Axelar offers, how it works under the hood, and why institutions are starting to take it seriously.

What is Axelar

Axelar is a decentralised network built to solve one of blockchain’s most persistent problems: interoperability. At its core, Axelar allows applications and blockchains that normally operate in silos to communicate with each other seamlessly.

Instead of needing developers to build a new bridge or integrate different protocols every time they want to connect to a new blockchain, Axelar provides a universal communication layer.

This layer allows tokens, data, and smart contract calls to move across over 79 different blockchain networks, including those that use different architectures or programming languages.

The project was built from the start to enable universal composability across all chains, regardless of whether they’re based on Ethereum, Cosmos, or Move (like Sui).

This means developers can focus on building their applications, while Axelar handles the complexity of secure and scalable cross-chain interactions.

How Does Its Infrastructure Work

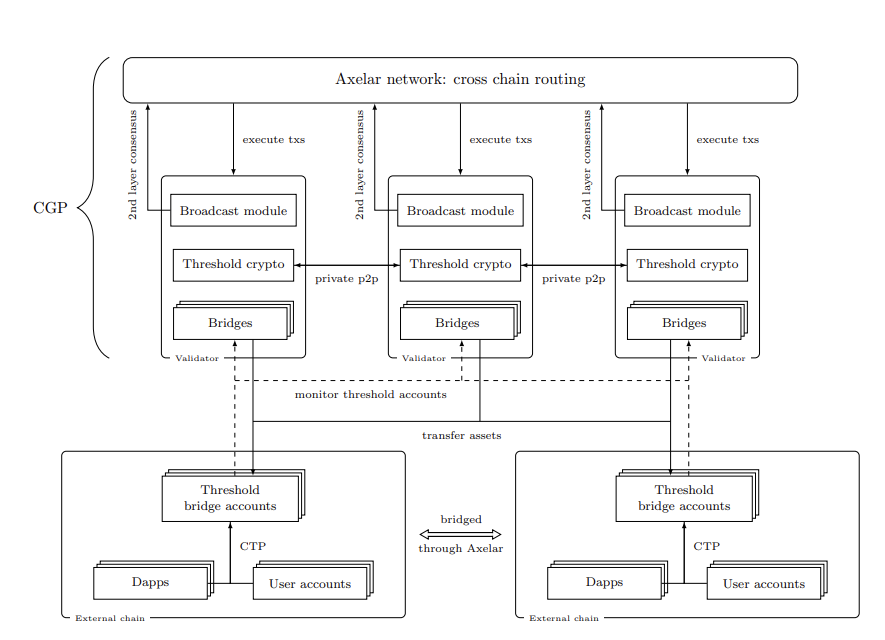

Axelar’s infrastructure is built around two main protocols: the Cross-Chain Gateway Protocol (CGP) and the Cross-Chain Transfer Protocol (CTP). The CGP acts like a global routing layer that finds the best path for data and token flows between blockchains.

It does not require any special changes on the source or destination chain. The CTP then allows developers to use simple API-like requests to transfer tokens, trigger smart contracts, or fetch state information from other chains.

To secure this system, Axelar uses a delegated proof-of-stake (DPoS) blockchain. Validators on the network run light clients of other blockchains to observe their states and reach consensus on external chain data.

They then use threshold cryptography to sign transactions and updates securely, ensuring that no single actor can compromise the system.

This design not only enables high levels of security and decentralisation, but also makes it possible to update or rotate validators without breaking communication between chains.

Crucially, Axelar’s validators do not need to write custom code for every chain they interact with. Instead, the system works like a universal translator that speaks all blockchain languages through a common protocol layer.

Can It Integrate with Other Chains?

Yes, and this is where Axelar shines. Its real strength lies in its ability to support communication between chains that are fundamentally different from each other. Recent integrations highlight how powerful this approach is becoming.

Take Sui, for example. Sui is built using the Move language and is designed for high scalability. Using Axelar’s Interchain Token Service (ITS), developers can now issue tokens that retain full functionality and fungibility across both Sui and other chains like Ethereum or Cosmos.

Regulated financial institutions are already experimenting with this, using Axelar to issue tokenised funds and stablecoins with compliance and audit capabilities baked in.

Another major example is XRPL, Ripple’s blockchain. Known for its speed and low-cost transactions, XRPL has historically been isolated from the broader Web3 ecosystem due to its lack of smart contracts.

Axelar changed that by connecting XRPL to its General Message Passing (GMP) protocol. For the first time, smart contracts on other chains can now read data from XRPL or even interact with XRPL assets directly.

This has unlocked use cases such as token transfers from Ethereum to XRPL and back, or using XRPL-based assets inside DeFi applications on chains like Arbitrum or Polygon.

With ITS, these tokens move across chains without losing their core properties, no wrapping required, no custom bridge code.

What makes this possible is Axelar’s commitment to universality. Whether the chain uses EVM, Cosmos SDK, Move, or even a custom consensus model, Axelar can connect them through a shared gateway and protocol suite.

The AXL Token

The recent surge in the AXL token’s price, which is up nearly 100% in a single day, wasn’t triggered by speculation alone.

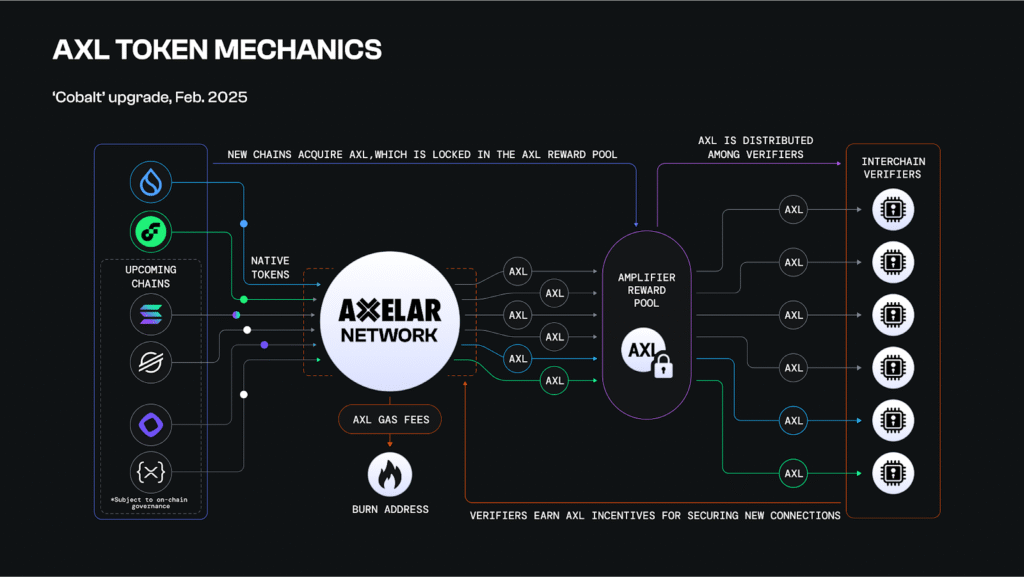

It follows a fundamental shift in Axelar’s tokenomics through the v1.2.1 “Cobalt” upgrade. Approved by on-chain governance, this upgrade radically alters how AXL is distributed, used, and burned.

Previously, Axelar relied on a model of incentivised inflation, which is where validators received added rewards each time a new blockchain was supported.

While this helped the network scale to over 69 connected chains, it also introduced ongoing token emissions. With the Cobalt upgrade, that model has been replaced.

Now, instead of relying on inflation, newly integrated blockchains must contribute AXL from the existing supply into a reward pool. This pool compensates “Verifiers”, validators securing connections for the new chain. No new tokens are minted to support this. It’s a deflationary pivot.

In addition, Axelar has implemented a gas fee burn mechanism. 98% of all AXL used to pay for cross-chain transactions is now permanently burned. Only 2% is retained for the community grant pool. Combined, these changes counterbalance the current inflation rate of 4.8% (as of February 2025) and may lead to a deflationary supply over time.

The shift turns $AXL into a utility token with built-in scarcity and real network function. Every new blockchain added via the Interchain Amplifier requires and locks up more AXL.

Already, recent integrations such as Sui and Flow are contributing over 300,000 AXL per month into reward pools. Upcoming integrations, including Solana, TON, XRP Ledger, Monad, and Stellar, are expected to increase this number significantly.

Unlike many interoperability solutions that rely on wrapped assets or closed bridges, Axelar operates entirely on a public blockchain with decentralised proof-of-stake validators.

This means the AXL token not only secures the network but also governs it. Builders and users alike benefit from token-driven decision-making and security guarantees.

In short, AXL’s recent price appreciation is underpinned by structural improvements. With token burns, reward pools, and growing real-world utility across compliant financial products and new blockchain integrations, AXL is no longer just a governance token, it’s a deflationary engine powering Axelar’s expanding interoperability layer.

Conclusion

Axelar is not just another interoperability protocol. It’s a fully functioning network with clear infrastructure, real-world integrations, and a growing list of supported chains.

Whether it’s powering compliance-ready financial products on Sui or unlocking cross-chain DeFi capabilities for XRP, Axelar is building the foundation for a connected Web3.

Before getting caught in the excitement of $AXL’s sudden price movement, it’s worth understanding what lies behind it. The rise isn’t based on hype alone, it’s tied to meaningful developments, protocol-level innovation, and actual usage by major networks and institutions.

For those looking to explore beyond isolated ecosystems and into a future of chain-agnostic applications, Axelar might just be the layer making that vision a reality.