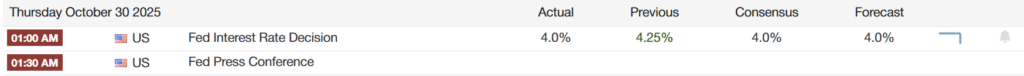

In the early hours of Thursday, 30 October 2025, the United States Federal Reserve announced a 25 basis point cut to its benchmark interest rate.

The decision lowered the target range from 4.25% to between 3.75% and 4%, marking the second consecutive reduction this year. The move was aimed at supporting an economy that shows signs of slowing growth and a softer labour market.

Yet, rather than boosting confidence, the statement that followed from Chair Jerome Powell introduced more uncertainty. His cautious tone suggested that the central bank itself was unsure about what to do next.

The Fed’s Decision and Its Economic Context

The Federal Reserve’s decision in October reflected a growing concern that the United States economy might be losing momentum.

Inflation has moderated from the highs of previous years but remains above the 2% target, sitting around 3%. Meanwhile, job creation has slowed, and several private surveys point to weaker hiring across many sectors. These mixed signals have placed the central bank in a difficult position.

By a vote of ten to two, the Federal Open Market Committee approved the quarter-point cut. Two members opposed the decision, with one calling for a larger move of 0.5% and another suggesting that the rate should remain unchanged.

Their disagreement illustrated how divided policymakers have become over the direction of future policy.

For months, the Federal Reserve has faced the challenge of making decisions with limited data. The ongoing government shutdown has delayed the publication of several major economic reports, including employment and retail figures.

Without this information, policymakers have been forced to rely on incomplete indicators and private estimates. Powell acknowledged this limitation openly, describing the situation as one where the central bank must proceed carefully because it lacks a full picture of the economy.

The October rate cut brought borrowing costs in the United States to their lowest point in three years. The move is expected to ease credit conditions for consumers and businesses, helping those with mortgages, car loans, and credit cards. Lower rates generally encourage spending and investment, but they also carry the risk of fuelling inflation if maintained for too long. Powell emphasised that the committee’s goal was to balance these competing priorities rather than commit to a fixed path of continuous cuts.

Alongside the rate adjustment, Powell announced that the Federal Reserve would officially end its process of balance sheet reduction on 1 December.

This policy, known as quantitative tightening, involved gradually shrinking the central bank’s holdings of government bonds and mortgage-backed securities.

Over the past three years, the balance sheet has been reduced by more than $2 trillion. Powell explained that the decision to stop this process was based on the belief that liquidity in financial markets is now sufficient.

By maintaining the current size of its balance sheet, the Federal Reserve aims to prevent unnecessary stress in short-term funding markets.

Powell also addressed the state of the labour market. He described it as “less dynamic and somewhat softer” than earlier in the year, noting that the pace of hiring had slowed.

According to private sector data, the United States lost approximately 32,000 jobs in September, the first monthly decline in more than a year.

Although unemployment remains low, this figure raised concerns about the health of the job market. Powell said that while there was no evidence of a sharp deterioration, the central bank must stay attentive to these changes.

The press conference reflected a mix of reassurance and caution. Powell pointed out that inflation away from the effects of tariffs has moved closer to the target, which suggests that price pressures are not worsening.

However, he also noted that the lack of government data means the true state of the economy could be better or worse than it appears. This uncertainty formed the central theme of his comments and shaped how markets reacted in the following hours.

Powell’s Cautious Message and Its Impact

Although the rate cut itself was widely expected, investors were surprised by Powell’s language during the press conference. Instead of signalling a clear direction for the months ahead, he emphasised that the next move would depend entirely on incoming data.

He warned that another rate cut in December “is not a foregone conclusion”, a phrase that quickly captured the attention of analysts and traders.

This statement effectively cooled hopes that the Federal Reserve would continue easing policy at the same pace. Powell explained that, without reliable data due to the government shutdown, the committee had little choice but to adopt a wait-and-see approach.

He compared the situation to driving in fog, where one must move slowly to avoid mistakes. The analogy reflected both the uncertainty and the caution that now define the central bank’s strategy.

Within the committee, views on how to proceed are increasingly divided. Some members believe that more rate cuts are necessary to prevent a deeper slowdown, while others worry that further easing could reignite inflationary pressures.

Powell admitted that these differences have grown stronger in recent meetings, with a “growing chorus” of officials calling for patience before any additional moves. This internal disagreement contributes to a broader sense that the Federal Reserve lacks a unified outlook on monetary policy.

Financial markets quickly adjusted to Powell’s cautious stance. Before the announcement, investors had priced in almost a 90% chance of another cut in December.

After his remarks, that probability dropped sharply, reflecting doubts about whether the central bank still has the conviction to keep lowering rates.

Equity markets that had initially risen on news of the rate cut soon turned volatile, and the US dollar strengthened slightly as traders reassessed their expectations.

Beyond the immediate market reaction, Powell’s comments also raised questions about the independence of the Federal Reserve. President Donald Trump has repeatedly criticised the chair for not cutting rates faster and has hinted at replacing him before his term ends next year.

This political pressure has placed additional scrutiny on every decision the central bank makes, with some analysts worrying that its credibility could be at risk if the perception of external influence grows stronger.

Globally, the cautious tone of Powell’s remarks has broader implications. Many investors around the world view US monetary policy as a key signal for global liquidity and capital flows. When the Federal Reserve cuts rates, it often encourages investment in riskier assets and emerging markets.

However, Powell’s hesitation suggests that such a period of easy conditions may not last. The uncertainty surrounding US policy could lead to more cautious behaviour across international markets in the months ahead.

Despite his careful tone, Powell left open the possibility of further cuts if conditions worsen. He stressed that the Federal Reserve would remain responsive to new data, especially once regular government reports resume.

Until then, decisions will likely be made on a meeting-by-meeting basis. This flexible stance allows the central bank to adapt quickly, but also means there is no clear roadmap for investors to follow.

Powell’s press conference, therefore, highlighted an uncomfortable truth. The Federal Reserve, known for guiding markets with clear communication, is now navigating a period where it has less information and greater internal disagreement.

This uncertainty has created confusion among traders and economists alike, who must now interpret each statement as a potential signal of future moves.

Conclusion

The Federal Reserve’s latest rate cut was intended to provide stability, yet Jerome Powell’s measured tone delivered the opposite effect. His refusal to commit to further easing left markets searching for direction.

While the lower interest rate and the end of balance sheet reduction may support economic growth, the lack of clarity about future policy has become a concern in itself.

Until the government resumes full data reporting and policymakers gain a clearer view of the economy, the central bank is likely to remain cautious. In the meantime, investors will continue to watch every Powell statement for clues about what comes next.