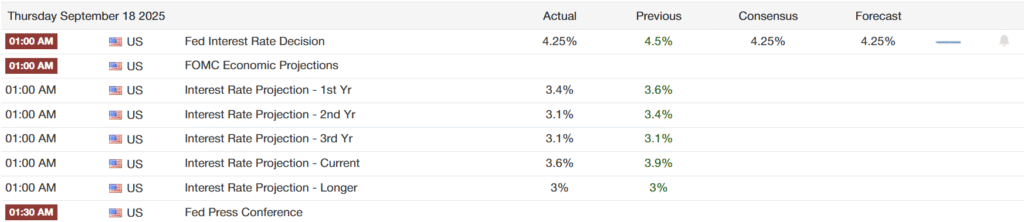

The US Federal Reserve has delivered its first rate cut of 2025, lowering the federal funds rate by 0.25 percentage points to a range of 4%–4.25%.

It is the first time in years that the Fed has moved rates downward, signalling a shift in its stance after months of battling persistent inflation while watching the labour market lose steam.

Chair Jerome Powell admitted that this single move would not dramatically change the economic picture, but it reflects a recalibration.

Growth is slowing, unemployment has crept up, and inflation remains above target. For investors, the new path matters: it sets the tone for how risky assets, including crypto, might behave in the coming months.

The Rate Cut and Its Immediate Impact

The cut marks a turning point in policy. For most of the last cycle, the Fed had been focused on keeping inflation under control. That focus was justified, as consumer prices ran well above the 2% target.

However, the summer months brought weaker job growth, with only modest gains in August, and unemployment nudged higher to 4.5%. The Fed’s statement acknowledged that the risks have shifted. Inflation is still too high, but downside risks to employment have now become more pressing.

Jerome Powell was careful in his language during the press conference. He said that tariffs introduced by the Trump administration have started to lift some prices, but insisted the broader impact is not yet clear.

More importantly, he pointed to immigration, noting that the supply of workers has fallen sharply and is constraining the jobs market.

In his view, weak hiring is more about fewer available workers than tariffs or business reluctance. Both supply and demand for labour have cooled, creating a balance that is not a healthy one.

The effect of the cut on households will be modest. Adjustable-rate mortgages, car loans, and credit card interest rates could edge down, offering some relief to borrowers.

But as Powell reminded journalists, mortgage rates in particular are only indirectly affected by Fed policy, and the shortage of homes is a structural issue that cannot be solved by a single quarter-point move. Savers, meanwhile, face lower returns on deposits.

Businesses may find credit slightly easier, but the Fed’s own projections confirm that the economy will not accelerate sharply.

Financial markets reacted cautiously. Equities rose initially, but gains faded during Powell’s comments.

He stressed that the Fed is “not on a pre-set path,” meaning investors should not assume this cut automatically leads to a series of reductions. The dot plot revealed a divide inside the Committee.

Nine officials see rates ending 2025 closer to 3.5%–3.75%, signalling more easing ahead, while others expect fewer cuts. One outlier even projected a much steeper fall.

These divisions underline the uncertainty facing policymakers as they try to balance inflation that remains sticky with a jobs market losing momentum.

Projections and Market Sentiment for Risky Assets

Alongside the rate cut, the Fed released its economic projections. They make sober reading. Real GDP growth is forecast at 1.6% in 2025, only slightly higher in the following years, suggesting that the economy will avoid recession but not deliver strong expansion.

Unemployment is expected to remain above 4% through 2028, a shift from earlier projections that showed more strength. Inflation, as measured by PCE, is seen declining gradually from 3% this year to 2% by 2028, with core inflation following a similar path.

The Fed’s median projection for the federal funds rate is 3.6% at the end of 2025, falling to around 3% in the longer run. That is a gentler pace of easing than many in markets hoped for.

The Committee also noted a high degree of uncertainty. Risks to growth are judged to be tilted downward, while risks to inflation are broadly balanced.

Powell made clear that each new set of data will shape decisions, a reminder that the Fed is wary of being seen as committing too early to a full easing cycle.

For investors, particularly those in equities and crypto, this creates a complex backdrop. Lower interest rates reduce the cost of capital and push investors toward riskier assets in search of returns.

This can support crypto markets, which often react strongly to changes in liquidity conditions. Yet the context is not straightforward.

The Fed is cutting rates not because the economy is booming, but because it sees weaker growth and rising labour market risks. That combination can temper enthusiasm.

Crypto has often thrived when investors expect easier policy and a weaker dollar. If inflation genuinely moves back toward 2% and the Fed follows through with more cuts, digital assets could benefit from renewed risk appetite. But the projections also hint at stagflation risks, with slow growth and stubborn prices.

In such an environment, markets may swing sharply between optimism and fear, making crypto especially volatile. Powell himself cautioned that “a quarter point won’t make a huge difference to the economy,” which suggests traders should not expect an immediate surge in liquidity.

Markets also face divisions similar to the Fed’s. Some participants are betting on two or more cuts by year-end, while others expect a pause.

That leaves crypto exposed to sentiment shifts with every new inflation print or jobs report. For long-term holders, the Fed’s acknowledgement that policy is turning is encouraging.

But for speculators, the path is anything but clear. The balance between inflation risks and employment concerns will determine how aggressive the Fed becomes, and that balance is still fragile.

Conclusion

The Fed’s first rate cut in years is a notable shift, but not a dramatic one. It reflects concern about jobs as much as inflation, and it sets out a cautious path forward.

Powell emphasised that decisions will remain data-driven, leaving markets to interpret each new report as a clue.

For risky assets like crypto, lower rates may provide support, but the weak growth outlook and divisions within the Fed add layers of uncertainty. Investors should welcome the easing but remain alert: the path ahead is uneven, and risk management is more important than ever.