The tokenisation narrative in global finance is growing rapidly. As traditional institutions move further into digital asset markets, real-world assets (RWAs) are increasingly being brought on-chain to improve transparency, liquidity, and accessibility.

Two recent developments highlight this shift. BlackRock, the largest asset manager in the world, advanced its tokenisation strategy, while Dubai’s Virtual Asset Regulatory Authority (VARA) approved the first institutional-grade tokenised fund in the region.

These events demonstrate that tokenisation is transitioning from early adoption to practical implementation, altering how institutional investors access capital markets.

BlackRock’s Tokenisation Strategy and the Institutional Shift

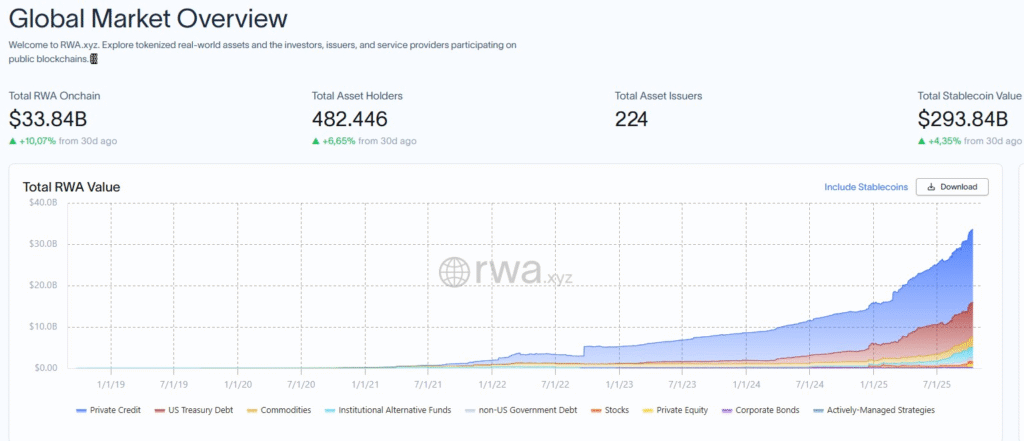

The RWA market recently reached an all-time high of $33.84 billion, reflecting rising demand for on-chain financial products.

Private credit is currently the largest sector, valued at $17.6 billion, followed by tokenised US Treasuries, which make up about 25% of the total market. BlackRock has emerged as one of the leading traditional finance institutions investing heavily in this transition.

BlackRock’s CEO, Larry Fink, confirmed that the firm is building proprietary technology for tokenising financial assets. During his appearance on CNBC’s Squawk on the Street on October 14, Fink described tokenisation as an opportunity to expand investor access to traditional investment products through blockchain.

He explained that tokenised exchange-traded funds could serve as an entry point for crypto native investors to participate in long-term instruments such as retirement funds without leaving the digital ecosystem.

This approach supports Fink’s view that digital assets can modernise financial infrastructure. He believes tokenisation can simplify asset ownership, improve transparency, and strengthen investor governance through real-time tracking and programmable compliance.

BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, leads the tokenised Treasuries market with $2.82 billion in assets, capturing 33.9% market share.

Competitors such as Franklin Templeton’s $860 million BENJI fund and Circle’s $589.7 million USYC fund remain behind.

The wider RWA market now includes more than 224 issuers and 482,000 asset holders, showing that institutional trust in blockchain systems is growing. Tokenised equities have also increased in value, reaching $688 million, close to their record of $712 million earlier this month.

Commodities such as Tether Gold and Paxos Gold dominate their category, bringing the total tokenised commodities value to $3.12 billion.

Fink’s remarks suggest that BlackRock sees tokenisation as a long-term foundation for its business. By moving traditional assets onto digital infrastructure, the firm hopes to merge the efficiency of blockchain with the security of regulated finance.

BlackRock’s ongoing efforts could set a model for how asset managers worldwide integrate tokenisation into existing systems, turning blockchain from an experiment into a key layer of global finance.

Dubai’s VARA Approves the First Institutional Tokenised Fund

Dubai is establishing itself as a leader in regulated digital finance. The Virtual Asset Regulatory Authority has given in principle approval to Laser Digital, the digital asset division of Nomura Group, to tokenise its flagship Laser Carry Fund (LCF).

This marks the first institutional grade tokenised fund under VARA’s regulation and represents a milestone for the United Arab Emirates in the global RWA movement.

The tokenised version of the fund, called TLCF, will operate on the KAIO blockchain within VARA’s pilot ARVA Framework.

Institutional investors who meet VARA’s eligibility criteria can subscribe and redeem tokens during specific time windows, with prices linked directly to the fund’s net asset value. Selected exchanges will handle secondary trading under strict compliance supervision.

Custody services will be provided by Komainu, a VARA-licensed custodian, ensuring that the digital fund units are held securely. This structure shows VARA’s balanced approach to innovation and regulation, combining blockchain flexibility with institutional safeguards.

Laser Digital’s CEO, Dr Jez Mohideen, highlighted that the approval is a major step in delivering secure and regulated RWA products.

Once fully licensed, the Laser Carry Fund will become the first tokenised investment option available to institutional investors in Dubai. It could open opportunities for further regulated blockchain-based asset management products across the region.

Earlier this year, QNB Group, Standard Chartered, and DMZ Finance launched the QCD Money Market Fund in the Dubai International Financial Centre, which was the first regulated tokenised fund in the area.

Capricorn Fund Managers acts as fund manager, and Standard Chartered provides custody for the assets.

Notably, Bybit later adopted the QCDT token as collateral, unlocking up to $1 billion in borrowing capacity and showing how tokenised RWAs can generate liquidity for institutional markets.

Neighbouring Bahrain is also embracing this shift. The crypto exchange ATME, licensed by the Central Bank of Bahrain, has introduced a regulated platform that enables brokers and asset managers to issue and trade tokenised investment products.

Together, Dubai and Bahrain are positioning the Gulf region as one of the most advanced hubs for RWA innovation. Their frameworks enable traditional financial institutions to adopt tokenisation safely and at scale.

Conclusion

The progress seen at BlackRock and VARA Dubai shows that real world asset tokenisation has moved beyond concept and into structured adoption.

From Larry Fink’s efforts to digitalise traditional investments to Dubai’s approval of the Laser Carry Fund, both examples reflect how traditional and digital finance are merging.

With total RWA value exceeding $33 billion, the next phase will involve broader participation from institutions, stronger regulatory clarity, and deeper blockchain integration.

Tokenisation is shaping a financial system where accessibility, transparency, and efficiency come together, connecting the old and new structures of global finance.