Scalability is one of the most important, yet often misunderstood, concepts in blockchain technology. It refers to the network’s ability to handle increasing demand, whether that’s more users, more transactions, or more data.

As blockchain adoption grows, scalability becomes essential for ensuring speed, efficiency, and long-term usability. But this concept is not as straightforward as it sounds.

Scalability is at the heart of one of blockchain’s biggest dilemmas, where improvements in one area can compromise others. Let’s break it down.

What is Scalability?

Scalability in blockchain is the capacity of a network to process a higher number of transactions per second without compromising performance, decentralisation, or security. It’s essentially how well a blockchain can keep up with growth.

When more people use the network, more transactions must be verified, stored, and confirmed. A scalable blockchain can handle this increase smoothly, maintaining low fees and fast speeds.

Unfortunately, most blockchains were not built for high-volume usage. For instance, Bitcoin was designed with decentralisation and security in mind, not speed.

It can only handle about 7 transactions per second. Ethereum, despite being more flexible, only processes around 15. Compare that to Visa, which averages 1,700 transactions per second, and the problem becomes obvious.

This challenge is often referred to as the Blockchain Trilemma, a term popularised by Ethereum’s co-founder Vitalik Buterin. It suggests that a blockchain can only maximise two out of three core traits: decentralisation, security, and scalability.

Improving scalability usually means compromising one of the other two, which is why achieving all three simultaneously has proven so difficult.

Why is Scalability Important for a Blockchain?

Scalability determines whether a blockchain can support widespread use. Without it, networks become congested, transactions slow down, and fees skyrocket.

This directly affects user experience and discourages adoption, especially in areas like DeFi, gaming, or payments, where speed and cost matter most.

Consider this: when Bitcoin’s popularity surges, transaction confirmation times often rise along with the fees.

Users then either wait longer or pay more to get their transactions processed. The same happens on Ethereum when popular apps like NFTs or decentralised exchanges see high demand. If these blockchains can’t scale, they risk becoming unusable at peak times.

Scalability also opens the door to more advanced use cases. It’s not just about speed, it enables everything from microtransactions and real-time gaming to large-scale enterprise applications. Without scalability, these services can’t function reliably on-chain.

In addition, scalability is vital for long-term sustainability. As blockchain becomes more integrated into financial services, global trade, and public infrastructure, it must meet the performance expectations of mainstream systems.

Otherwise, traditional alternatives will remain dominant, and blockchain’s potential will remain untapped.

Use Cases of Scalability

Bitcoin is often used as the classic example of a blockchain that lacks scalability. While it’s incredibly secure and decentralised, its limited throughput and high confirmation times make it difficult to use for everyday payments.

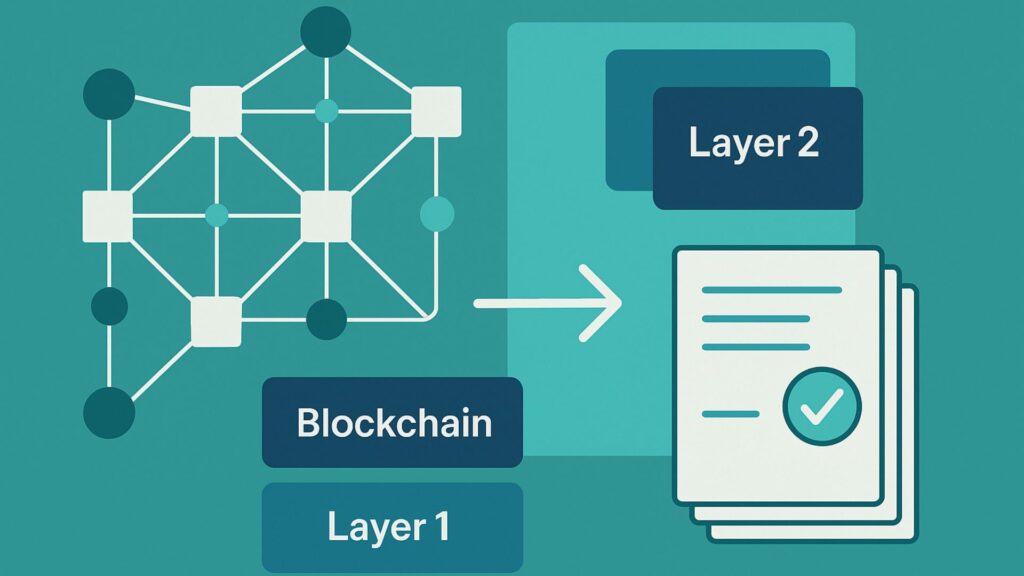

This is where Layer 2 solutions come in, technologies built on top of the base layer that help scale the network without changing its core design.

The Lightning Network, for example, allows users to conduct Bitcoin transactions off-chain through payment channels.

These transactions are instant and cost less than a cent, only settling on the Bitcoin blockchain when the channel is closed. This drastically improves efficiency while preserving security.

Similarly, Ethereum has embraced scalability through both Layer 1 and Layer 2 solutions. On the Layer 1 side, Ethereum is moving towards sharding, a method of splitting the network into smaller parts, or shards, to process transactions in parallel.

On Layer 2, solutions like Optimistic Rollups and zkRollups bundle thousands of transactions into one and post the result on-chain, increasing capacity while reducing fees.

These developments are not limited to Bitcoin and Ethereum. Entire ecosystems like Arbitrum, Polygon, Stacks, and Merlin Chain have emerged to offer faster, more scalable blockchain environments.

In doing so, they are unlocking use cases such as decentralised finance (DeFi), gaming, smart contracts, and even tokenised assets on top of Bitcoin, which previously wasn’t possible.

Without these scalability layers, networks like Bitcoin would struggle to serve more than a niche market. With them, they can compete with traditional systems and become infrastructure for real-world finance.

Risks of Scalability

Scaling a blockchain isn’t without its risks. Most of the time, improving scalability means shifting complexity elsewhere, either by reducing decentralisation, creating potential security gaps, or introducing new user challenges.

One major concern is centralisation. Some Layer 2 networks rely on a few validators or node operators to process transactions, which can contradict the decentralised ethos of blockchain.

For example, larger nodes in the Lightning Network might become dominant hubs, concentrating power and trust in the hands of a few actors.

Another risk is security. By moving transactions off-chain or onto sidechains, some of the security benefits of the main blockchain may be lost. If a Layer 2 network suffers a failure or exploit, users might lose funds even though the base layer remains secure.

Complex bridge mechanisms, which transfer assets between chains, are also vulnerable and have been exploited multiple times in recent years.

Usability is also a hurdle. Many Layer 2 solutions require users to learn new wallets, interfaces, or transaction processes. For non-technical users, this can be a barrier to entry. Without simpler tools, widespread adoption of scalability solutions may lag.

Finally, interoperability poses a challenge. Not all Layer 2 networks work seamlessly with each other or the main chain. This can result in fragmented ecosystems where users are locked into one network or face difficulties moving assets across chains.

Conclusion

Scalability is a fundamental concept that will shape the future of blockchain technology. It determines whether networks can meet growing demand, support mainstream adoption, and power complex applications without breaking under pressure.

Although Bitcoin and other early blockchains were not designed with scalability in mind, the rise of Layer 2 solutions and next-generation architectures has opened new pathways forward.

These innovations are allowing blockchains to process more transactions, at lower costs and faster speeds, without losing sight of decentralisation and security.