The cryptocurrency market has entered a turbulent phase this week, with billions of dollars wiped from its overall value in a matter of hours.

Bitcoin has fallen below $113,000 while Ethereum has dropped under $4,200, dragging the wider market to a market cap of around $3.8 trillion. Over $1.7 billion in leveraged positions have been liquidated, adding to the intensity of the selloff.

This article examines the main reasons behind the crash, including leverage wipeouts and wider macroeconomic pressures, before considering whether this downturn signals deeper trouble or a short-lived reset.

Why did the Market Crash Today?

The most immediate cause of the current market downturn is the liquidation of leveraged positions. In the past 24 hours alone, roughly $1.7 billion in crypto longs were wiped out, affecting more than 400,000 traders.

Ethereum bore the brunt of this pressure, losing almost $500 million in long liquidations, while Bitcoin saw around $280 million cleared. These forced sales created a domino effect, turning what began as a pullback into a sharp crash.

When leverage builds across major assets, even a modest decline can trigger mass liquidations, amplifying losses across the board.

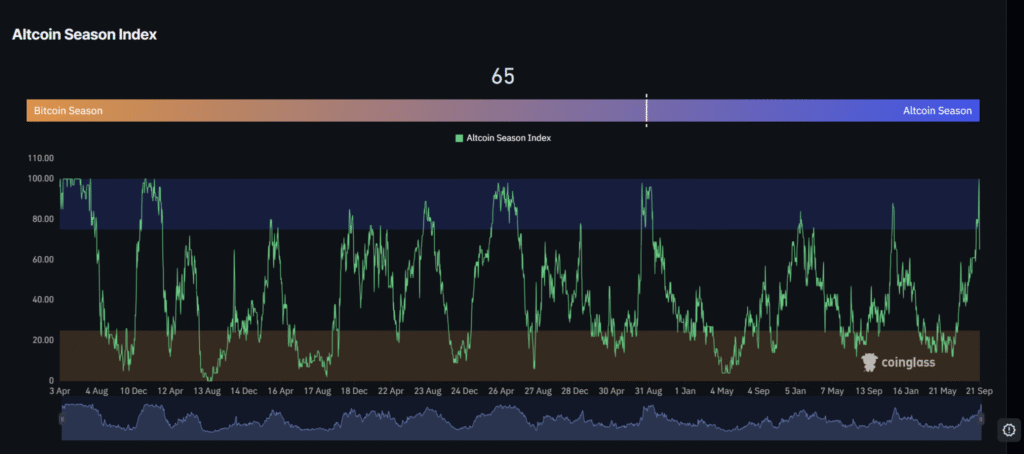

This crash has also brought an abrupt end to what had been described as an altcoin season. Smaller tokens that had been surging in recent weeks fell sharply as the cascade of liquidations spread beyond Bitcoin and Ethereum.

Coins such as Solana, Cardano, and XRP each lost more than 7%, while some smaller names, including Dogecoin and HYPE, tumbled by more than 10%.

The altcoin season index, which had hit a peak of 100 points just days ago, has now fallen back to 67. This shift underlines how quickly speculative rallies can be undone once leverage unwinds.

Beyond liquidations, the wider macroeconomic backdrop has added pressure. U.S. bond yields are at a critical point, shaping the flow of money into risk assets like crypto.

Analysts have noted that two-year Treasury yields, which influence investor appetite for risk, are sitting near key levels that could determine the market’s next direction.

At the same time, enthusiasm from the Federal Reserve’s recent rate cut has faded. Fed Chair Jerome Powell emphasised caution in future moves, signalling that further cuts are not guaranteed.

This reduced optimism in policy support has weighed heavily on sentiment, compounding the damage caused by leveraged positions being cleared out.

Is It Down Only from Here?

The scale of the crash has understandably sparked concern among investors, yet many analysts see it as a reset rather than the start of a long decline. Some traders argue the market was overdue for a shakeout, with excessive leverage building across both major tokens and altcoins.

By clearing out these positions, the market may be healthier in the medium term, with prices better aligned to genuine demand rather than speculative bets. Historically, such flushes have set the stage for renewed rallies, as fresh buyers step in to take advantage of lower prices.

Bitcoin’s retreat to around $112,000 is being closely watched as a possible accumulation zone. Analysts highlight the potential for an inverse head-and-shoulders pattern, which, if confirmed, could signal a rebound toward $130,000.

Another trader, Michaël van de Poppe, described the decline as part of a broader liquidity sweep, a move that often precedes major rallies.

The $110,000 to $113,000 range is being identified as an important area where buying interest may return. If this zone holds, it could provide the foundation for another upward phase.

The total crypto market cap offers further clues. It currently sits around $3.83 trillion, testing the 50-day simple moving average near $3.87 trillion.

A decisive close below this could open the door to a slide toward the 100-day average at about $3.68 trillion. However, as long as the market remains above that level, the longer-term bullish structure is intact.

The 200-day average, which sits near $3.31 trillion, continues to provide a strong foundation for the broader uptrend. This suggests that while volatility is unsettling in the short term, the longer-term picture remains constructive.

Institutional demand also points to underlying strength. Spot Bitcoin exchange-traded funds recorded nearly $900 million in inflows last week, while Ethereum spot ETFs attracted around $500 million for the second week in a row.

This steady accumulation indicates that larger players are taking advantage of lower prices, reinforcing confidence that the correction is not a signal of collapse but part of the natural rhythm of a bull market.

Conclusion

The current market crash is best understood as the product of two forces: the unwinding of overleveraged positions and a cautious macroeconomic backdrop.

More than $1.7 billion in liquidations has shaken out optimistic traders, ending a short-lived altcoin season and dragging the wider market lower.

Yet history shows that such events can strengthen market structures, allowing prices to reset and paving the way for new momentum.

With Bitcoin holding around $112,000 and institutions continuing to buy, the next few sessions will be critical in determining whether this decline marks a pause before recovery or the start of a deeper correction.